InstantCREDIT Course

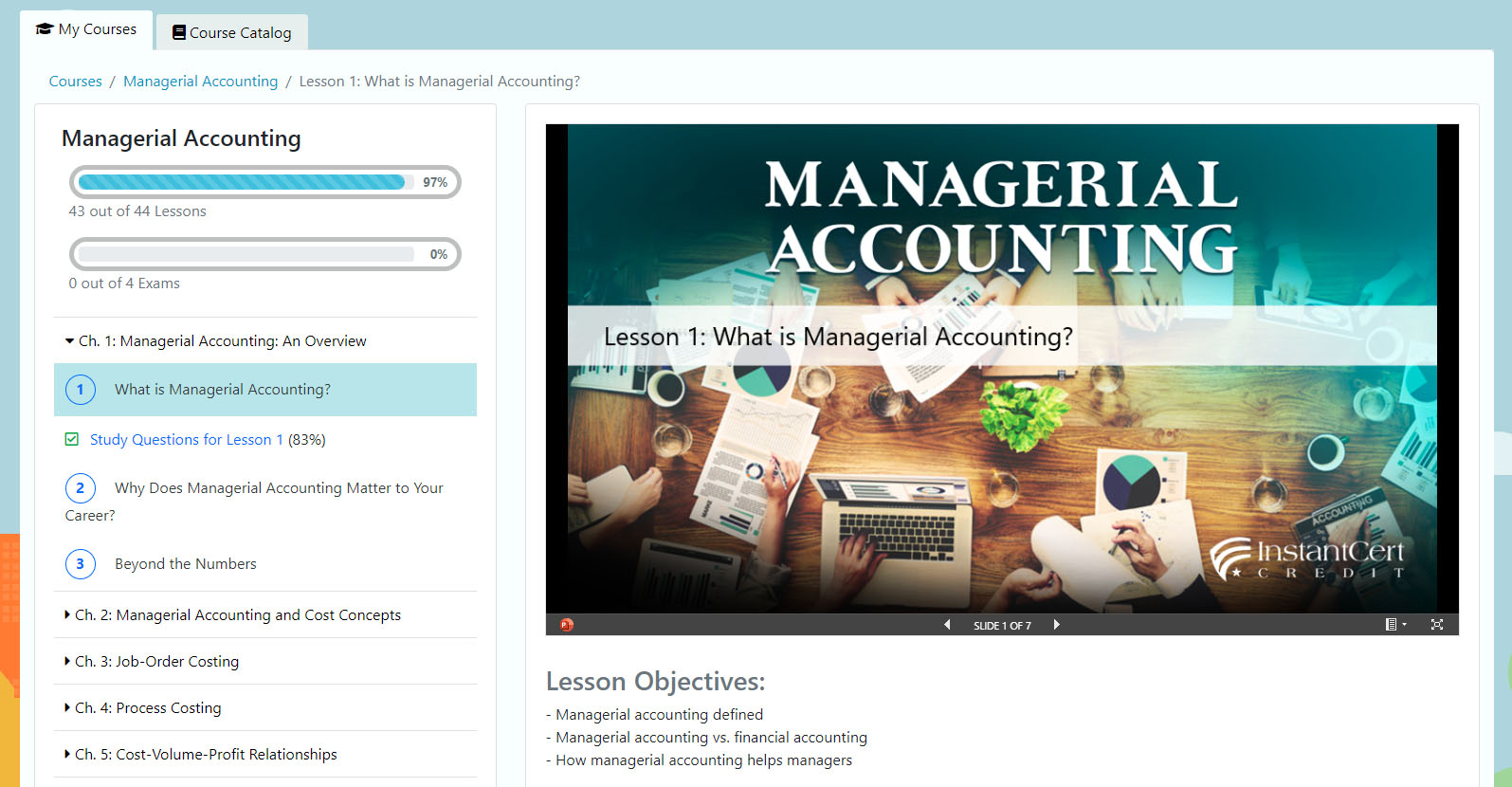

Managerial Accounting

This course will serve as an introduction to managerial accounting, starting with the basics about cost concepts, budgeting, and performance analysis and moving on to fundamental concepts like costing methods, master budgets, budget variance analysis, capital budgeting, and financial statements analysis.

At a Glance

Course Value: 3 Credit Hours

Course Level: Upper-Level Undergraduate

Course Length: 44 lessons

🗎 Download Syllabus in Word Format

Course Level: Upper-Level Undergraduate

Course Length: 44 lessons

🗎 Download Syllabus in Word Format

Course Outline

Click on a chapter name below to expand and see the lessons contained in that chapter.

Ch. 1: Managerial Accounting: An Overview- 2: Why Does Managerial Accounting Matter to Your Career?

- 3: Beyond the Numbers

- 5: Cost Classifications for Manufacturing Companies

- 6: Cost Classifications for Preparing Financial Statements

- 7: Cost Classifications for Predicting Cost Behavior

- 8: The Analysis of Mixed Costs

- 9: Traditional and Contribution Format Income Statements and Cost Classifications for Decision Making

- 11: Job-Order Costing: The Flow of Costs

- 12: Schedules of Cost of Goods Manufactured and Cost of Goods Sold

- 13: Underapplied and Overapplied Overhead: A Closer Look

- 15: Process Costing: Cost Flow

- 16: Process Costing: Equivalent Units of Production (Weighted-Average Method)

- 17: Process Costing: Equivalent Units of Production (FIFO Method)

- 19: Break-Even and Target Profit Analysis

- 20: Considerations in Cost Structure and Sales Mix

- 22: Segment Reporting: Tools for Management

- 24: Activity-Based Costing: Design and Mechanics

- 25: Activity-Based Costing: Decision Making

- 27: Master Budgeting: Preparing The Master Budget Part 1

- 28: Master Budgeting: Preparing The Master Budget Part 2

- 30: Flexible Budget Variances

- 32: Standard Costs: Variance Analysis

- 34: Performance Measurement: Operating and Balanced Scorecard

- 36: Differential Analysis, The Key to Decision Making: Additional Decisions

- 37: Differential Analysis, The Key to Decision Making: Other Decision Considerations

- 39: Capital Budgeting Decisions: Capital Budgeting Methods

- 40: Capital Budgeting Decisions: Additional Capital Budgeting Methods

- 42: Statement of Cash Flows: Example

- 44: Financial Statement Analysis: Ratios

Course Requirements

All of our courses are scored on a 1,000 point scale. You must accumulate a total of 700 points in the course to pass the course. Below is the breakdown of how points are allocated:

| Study Questions | 300 points |

| Graded Exam #1 | 100 points |

| Midterm Exam | 200 points |

| Graded Exam #2 | 100 points |

| Final Exam | 300 points |

For additional details on the assignments, exams, and retake policies, check the syllabus for this course (link provided near the top of this page).

Exam Proctoring

The Final Exam for this course is administered in conjunction with a 3rd party online proctoring service, PSI Services' RPNow. RPNow proctoring allows you to take the exam on a desktop or laptop computer from anywhere you have internet access at any time, no scheduling required.

Proctoring costs $15 (paid directly to PSI Services at the time of the exam) and is ONLY required for the final exam.

Earning Credit for this Course

This course has been reviewed by ACE Credit and is recommended for 3 Upper-Level credit hours. Upon successful completion of this course, it will be added to your ACE transcript which is then sent to your school to be evaluated for transfer credit.

Getting Started

All InstantCert subscribers get access to our InstantCREDIT courses. There are no hidden fees or registration periods. Create an account and start your course today.